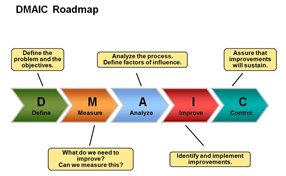

Another Question from Six Sigma DMAIC

Another Question from Six Sigma DMAIC

Another question from Six Sigma DMAIC

UTI 3 years average annualized return on mutual fund is 10% and standard deviation is 2.2.

TATA 3 years annualized return on same mutual fund is 8% and standard deviation is 4. Which is the better company (in terms if less risk) to invest on? Explain.

3 THOUGHTS ON “ANOTHER QUESTION FROM SIX SIGMA DMAIC”

Shishu Pal

Shishu Pal

Comments (0)

Facebook Comments